您现在的位置是:Fxscam News > Exchange Dealers

Oil prices rise, boosted by US

Fxscam News2025-07-22 09:22:28【Exchange Dealers】2人已围观

简介Can I get back the digital currency if I was cheated?,Yide Sports real-person registration and account opening safety 45yb point in,International oil prices continued their upward trend in early Asian trading on Monday, supported by

International oil prices continued their upward trend in early Asian trading on Can I get back the digital currency if I was cheated?Monday, supported by multiple favorable factors, and market concerns about escalating trade tensions eased. Previously, U.S. President Trump announced a delay in the imposition of a 50% tariff on the EU until July 9th. This decision allowed extra time for U.S.-EU trade negotiations and bolstered market confidence in the short term.

At the time of writing, Brent crude futures were steady, priced at $64.95 per barrel, and U.S. WTI crude futures increased by 0.30% to $61.71 per barrel. Continuing Friday's gains, oil prices remain above key support levels.

Trump's previous tariff threats had sparked widespread market concerns, and the extension decision is seen as a temporary ease in U.S.-EU trade tensions. The EU previously stated the need for more time to advance the agreement process, and Trump promptly provided an additional window, effectively soothing global trade tension.

Meanwhile, geopolitical tensions also provided support. Although progress in U.S.-Iran nuclear negotiations was limited, it was enough to allay concerns about a massive return of Iranian crude to the market. Monday coincided with the last trading day before the U.S. Memorial Day holiday, with some covering of short positions also driving oil prices higher.

On the supply side, signs of contraction in U.S. oil company production capacity are evident. According to energy industry data, the number of active oil rigs in the U.S. has fallen to 465, the lowest level since November 2021. This change reflects that under the current price environment, some companies are starting to control capital expenditure and restrict supply expansion.

However, the upward momentum in the oil market also faces potential challenges. OPEC+ is expected to announce an increase in daily production by more than 410,000 barrels from July at next week's meeting. In addition, the voluntary reduction quota of 2.2 million barrels per day could be entirely lifted by the end of October. The group has already incrementally increased production by about 1 million barrels per day from April to June, adding variables to subsequent market balance.

From a technical perspective, WTI crude prices have broken through the short-term moving average resistance, and technical indicators show strengthening bullish momentum. Prices are currently approaching the critical resistance level of $62. If successfully breached, further gains to $64 are expected; conversely, if retraced, $60 will become the primary support.

Overall, the oil market is maintaining a strong short-term volatility pattern. The market is closely watching the results of the OPEC+ meeting and further developments in U.S.-EU trade negotiations to gauge the direction of future price trends.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(97125)

相关文章

- IM Markets: A High

- The fall in the occupancy rate cannot prevent Manhattan rents from reaching a new historical high.

- Hollywood Proposes New Offer to Striking Writers: Involves Artificial Intelligence and Audience Data

- BHP's profits plummet, but confidence in the Chinese market remains strong.

- How should one transfer accounts in XM? How does one change agents?

- Thailand's KBank plans to acquire Vietnam's Home Credit for $1 billion.

- Yellow's bankruptcy is just the tip of the iceberg in the U.S. freight decline.

- New York bans the use of TikTok on government devices

- Is Aircrypt Trades compliant? Is it a scam?

- The forecast for office travel expenses shows that the demand for business travel has returned.

热门文章

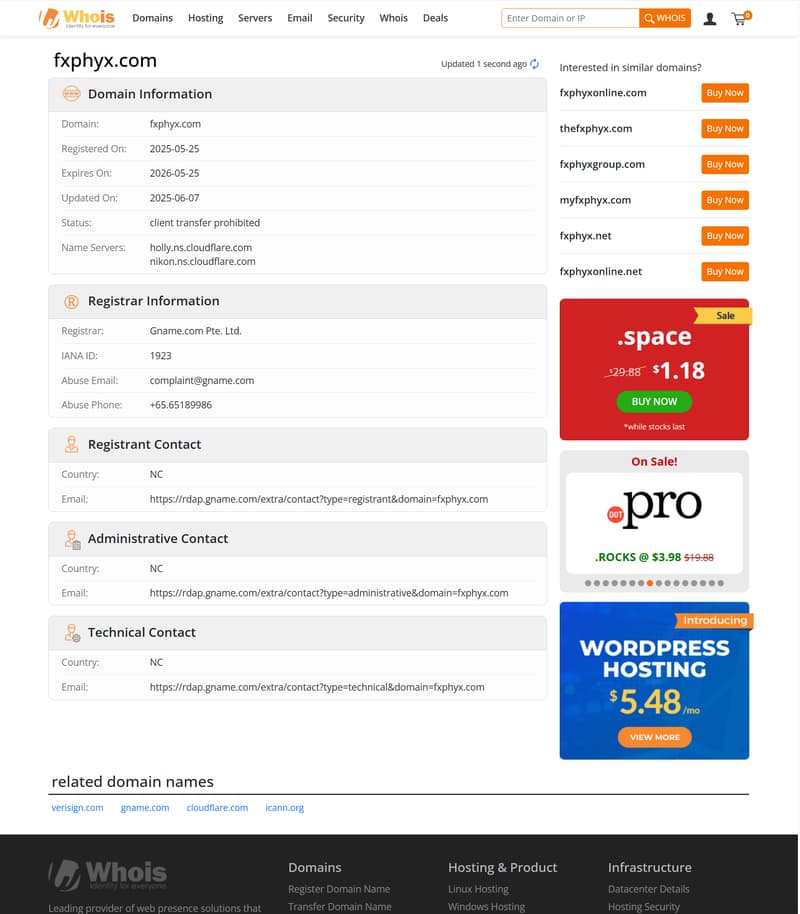

- Jason Sanders Scam Exposed: A Fictional Expert Created by ForexPhyx & AIC

- 8.18 Industry Update: Catherine Yien has been appointed head of HKEX Listing Issuer Regulation.

- Several countries protest against Japan's discharge of nuclear wastewater into the Pacific.

- On 9/28: HKEX will launch its new IPO platform FINI on November 22.

站长推荐

The fall in the occupancy rate cannot prevent Manhattan rents from reaching a new historical high.

迈达克新规下,新经纪商如何申请到MT5?是否还有第二选择

AMICUS FINANCE Scam Exposed: How David Analyst Manipulates Investors

Latecomers take the lead! European automakers worry about China's EVs.

Fecc Global is a Scam: Stay Away!

Australia's private lending sector gains new momentum: ADIA reinvests $450 million

假冒和套用?一文了解Yingke的诈骗小手段

Australasian Capital Pty Ltd’s Australian financial license is suspended; Hyphe gains BaF.